The Biosimilar Opportunity: Quarterly Update No.2 – August 2020

In October 2019, the Center for Medical Economics and Innovation at the Pacific Research Institute, under the direction of Dr. Wayne Winegarden, released its second study documenting the savings potential enabled by biosimilars. Biosimilars are medicines manufactured in, or derived from, biological sources that are developed to be similar to FDA-approved reference products. Biosimilars are only approved to compete in nine biologic drug classes in the U.S., and are available in seven of these drug classes currently. Europe, for comparison, has approved more than three times as many biosimilars as the U.S. Another problem, except for the Filgrastim drug class (the biosimilar Zarxio), biosimilars have not gained a meaningful share of the U.S. market where they are available.

Despite these obstacles, the October 2019 study found that biosimilars still generate over $240 million in total savings. If biosimilars grew to 25 percent, 50 percent, and 75 percent of the market, the study found the potential savings would be $2.4 billion, $4.7 billion, and $7.0 billion, respectively based on data through the beginning of 2019. Due to the large potential savings, solving the obstacles preventing wider adoption of biosimilars is imperative.

Updating the analysis, this Issue Brief projects the potential savings that wider use of biosimilars can generate for 2020. These projected savings are based on the volume data through June 2020 and pricing data that are valid through 2020 Q2. To ensure consistency with future updates, the savings potential for each biologic drug class is calculated relative to each originator biologic’s price prior to biosimilar entry. As a result, the potential savings will be larger than the estimates from October 2019 since these estimates also capture the savings created when the originator biologics lower their prices in response to greater biosimilar competition.

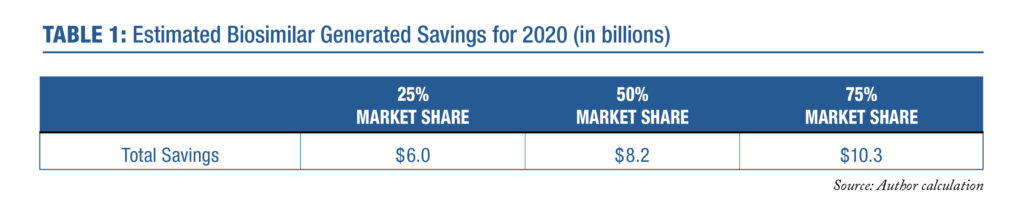

Table 1 demonstrates that the total potential savings could be as high as $10.3 billion in 2020, if biosimilars were to obtain 75 percent market share. If biosimilars represented 25 percent of the biologics market in these 9 drug classes, which would still be a large increase, the potential savings in 2020 would be $6.0 billion. However, without effective policy and market reforms, it will be difficult for the healthcare system to realize these large potential savings that biosimilars offer.

Table 2 distributes these savings by state. It is important to note that the total of the state savings does not equal the total savings for the nation because a share of purchases is not accrued to any specific state (e.g. savings accrued to territories). Table 2 illustrates that the potential savings if biosimilars had a 75 percent market share would range from $8.7 million in Wyoming to $734.0 million in California.

Endnotes

1. Winegarden W (2019) “Incenting Competition to Reduce Drug Spending: The Biosimilar Opportunity” Pacific Research Institute: Center for Medical Economics and Innovation, July; https://www.pacificresearch.org/wp-content/uploads/2019/07/BiosimilarsCompetition_F.pdf. Winegarden W (2019) “The Biosimilar Opportunity:

A State Breakdown” Pacific Research Institute: Center for Medical Economics and Innovation, October;

https://www.pacificresearch.org/wp-content/uploads/2019/10/BiosimilarSavings_web.pdf.

2. Hartson, A (2019) “How the U.S. Compares to Europe on Biosimilar Approvals and Products in the Pipeline” Rothwell Figg, May 7; https://www.biosimilarsip.com/2019/05/07/how-the-u-s-compares-to-europe-on-biosimilar-approvals-and-products-in-the-pipeline-4/.

3. Readers interested in an in-depth description of the data and sources should refer to the original studies.